Atlas Lithium Corp. (ATLX:NASDAQ) subject of an an update about a week ago on April 30, is worth bringing to your attention again this morning.

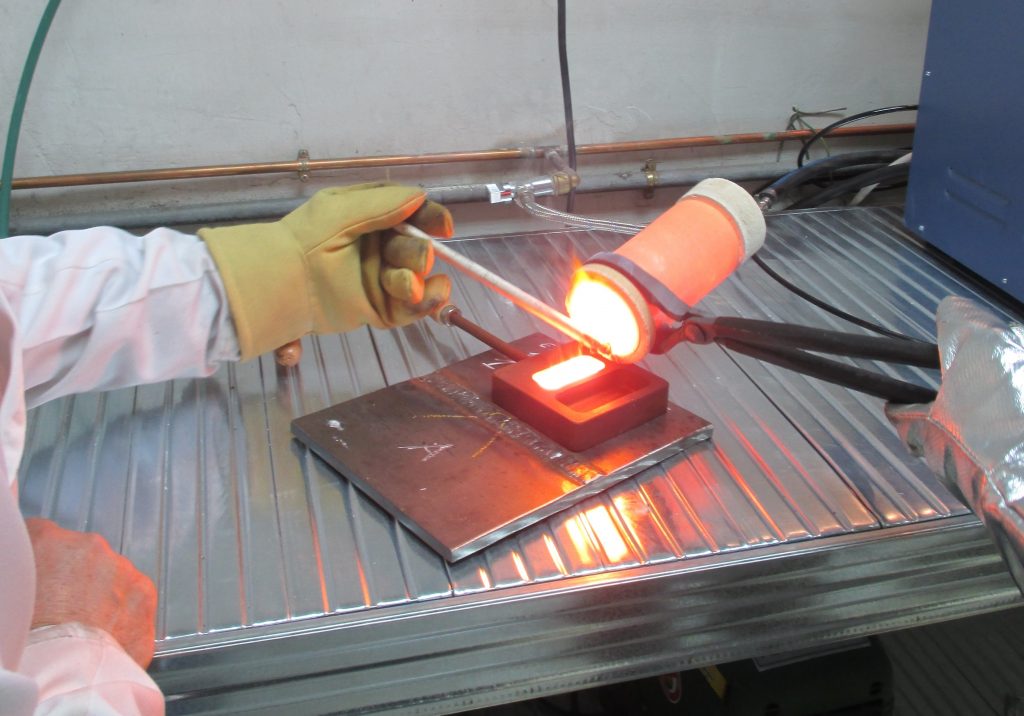

There is big news out of the company that Atlas Lithium's Modular Processing Plant Enters the Final Fabrication and Trial Assembly Stage.

The first few paragraphs of this news release make clear that the company is making rapid and substantial progress with this — in layman's terms, "they are not messing around."

Here are several photos of the lithium processing plant from the news release.

Now we will briefly review Atlas Lithium's latest stock chart, on which we see that the pattern that has formed since mid-February approximates a Head-and-Shoulders bottom.

With the price having reacted back to a support level and volume easing back to a relatively low level, the Accumulation line holding up well on the reaction, and momentum (MACD) now trending higher, everything is in place for the stock to advance anew. It is now starting higher again and it is thought that this morning's news out of the company could give it a boost.

We, therefore, stay long, and Atlas Lithium is rated a Strong Buy for all timeframes.

Atlas Lithium's website.

Atlas Lithium Corp. (ATLX:NASDAQ) closed at $14.67 on May 6, 2024.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Atlas Lithium Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Atlas Lithium Corp

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.